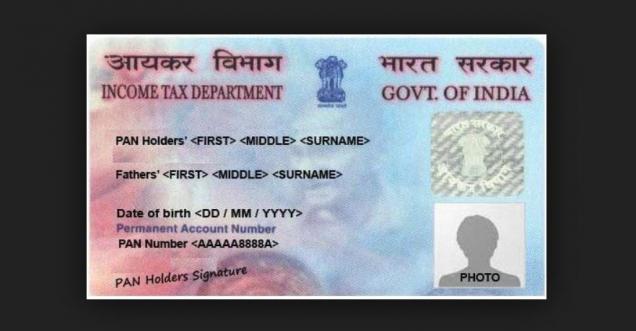

New Delhi: The Supreme Court has said that the Aadhaar card cannot be compulsory for income tax return till the final decision of the Constitution bench comes. The Supreme Court has also said that those who do not have the Aadhaar card, the government cannot insist on linking them with the PAN card. But those who have the Aadhaar card will have to add it to the PAN card. In fact, the Supreme Court, on the petitions challenging the constitutional validity of the provisions of the Income Tax Act, which made the mandatory for filing income tax returns and for allotment of PAN. On this issue, Justice AK Sikri and the bench of Justice Ashok Bhushan had reserved their verdict on the petitions on May 4.

These petitions were challenged under section 139 AA of Income Tax Act, which was implemented through this year's Budget and Finance Act, 2017. Section 139A of the Income Tax Act or mandatory enrollment ID of the Aadhaar application form, making it mandatory from July 1 this year to file returns and apply for allotment of PAN.

Opposition to the government's move, petitioners from the CPI leader Binoy Viswam had claimed before the bench that the Center could not underestimate the order of the top court's 2015 order in which the foundation was said to be voluntary.

It is important that the central government started a new facility to connect the permanent Account number to the Aadhaar card number in May. The government has made mandatory Aadhaar card numbers along with PAN card numbers for filing income returns. This will be effective July 1, 2017.