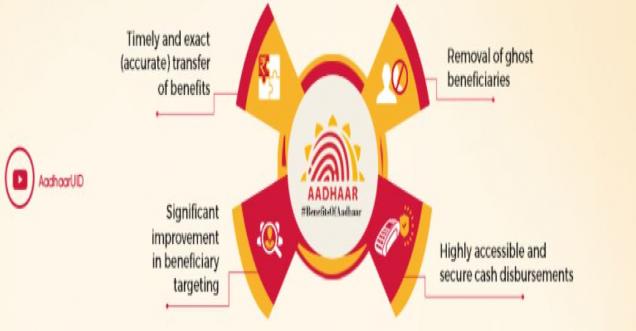

NewDelhi: Following are the major highlights of the Hon'ble Supreme Court of India's Judgement on Aadhar PAN Linkage:

The Hon’ble Supreme Court of India in its Landmark Judgement has upheld Section139AA of the Income Tax Act,1961 as constitutionally valid which required quoting of the Aadhaar number in applying for PAN as well as for filing of income tax returns.

The Hon’ble Court also held that the “Parliament was fully competent to enact Section 139AA of the Act and its authority to make this law was not diluted by the orders of this Court.”Therefore, no violation of the earlier Supreme Court orders were found in enacting the provision.

The Hon’ble Courthas also held that Section 139AA of the Act is not discriminatory nor it offends equality clause enshrined in Article 14 of the Constitution.

Section 139AA is also not violative of Article 19(1)(g) of the Constitution in so far as it mandates giving of Aadhaar number for applying PAN and in the income tax returns and linking PAN with Aadhaar number.

Section 139AA(1) of the Income Tax Act,1961 as introduced by the Finance Act, 2017 provides for mandatory quoting of Aadhaar/Enrolment ID of Aadhaar application form, for filing of return of income and for making an application for allotment of PAN with effect from 1st July, 2017.

Section 139AA(2) of the Income Tax Act,1961 provides that every person who has been allotted PAN as on the 1st day of July, 2017, and who is eligible to obtain Aadhaar, shall intimate his Aadhaar on or before a date to be notified by the Central Government. The proviso to section 139AA (2) provides that in case of non-intimation of Aadhaar, the PAN allotted to the person shall be deemed to be invalid from a date to be notified by the Central Government.

The Hon’ble Supreme Court has upheld Section 139AA(1) which mandatorily requires quoting of Aadhaar for new PAN applications as well as for filing of returns.

The Hon’ble Supreme Court has also upheld Section 139AA(2) which requires that the Aadhaar number must be intimated to the prescribed authority for the purpose of linking with PAN.

It is only the proviso to Section 139AA(2) where the Supreme Court has granted a partial stay for the time being pending resolution of the other cases before the larger bench of the Supreme Court. The Hon’ble Supreme Court has unequivocally stated as follows:

“125. Having said so, it becomes clear from the aforesaid discussion that those who are not PAN holders, while applying for PAN, they are required to give Aadhaar number. This is the stipulation of sub-section (1) of Section 139AA, which we have already upheld. At the same time, as far as existing PAN holders are concerned, since the impugned provisions are yet to be considered on the touchstone of Article 21 of the Constitution, including on the debate around Right to Privacy and human dignity, etc. as limbs of Article 21, we are of the opinion that till the aforesaid aspect of Article 21 is decided by the Constitution Bench a partial stay of the aforesaid proviso is necessary. Those who have already enrolled themselves under Aadhaar scheme would comply with the requirement of sub-section (2) of Section 139AA of the Act. Those who still want to enrol are free to do so. However, those assessees who are not Aadhaar card holders and do not comply with the provision of Section 139(2), their PAN cards be not treated as invalid for the time being. It is only to facilitate other transactions which are mentioned in Rule 114B of the Rules. We are adopting this course of action for more than one reason. We are saying so because of very severe consequences that entail in not adhering to the requirement of sub-section (2) of Section 139AA of the Act. A person who is holder of PAN and if his PAN is invalidated, he is bound to suffer immensely in his day to day dealings, which situation should be avoided till the Constitution Bench authoritatively determines the argument of Article 21 of the Constitution. Since we are adopting this course of action, in the interregnum, it would be permissible for the Parliament to consider as to whether there is a need to tone down the effect of the said proviso by limiting the consequences.”

Finally the effect of the judgement is as following

(i) From July 1, 2017 onwards, every person eligible to obtain Aadhaar must quote their Aadhaar number or their Aadhaar Enrolment ID number for filing of Income Tax Returns as well as for applications for PAN;

(ii) Everyone who has been allotted permanent account number as on the 1st day of July, 2017, and who has Aadhaar number or is eligible to obtain Aadhaar number, shall intimate his Aadhaar number to income tax authorities for the purpose of linking PAN with Aadhaar;

(iii) However, for non-compliance of the above point No.(ii), only a partial relief by the Court has been given to those who do not have Aadhaar and who do not wish to obtain Aadhaar for the time being, that their PAN will not be cancelled so that other consequences under the Income Tax Act for failing to quote PAN may not arise.