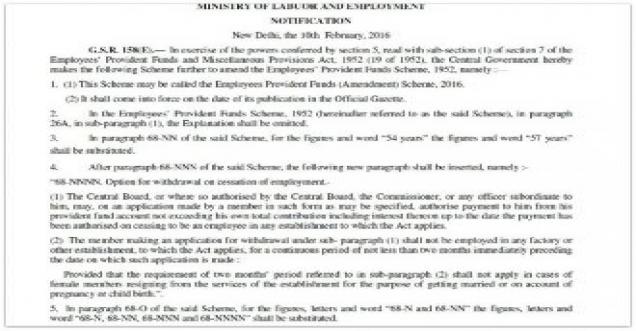

The Government of India, has recently made a few amendments in the Employees’ Provident Fund Scheme, 1952 (PF Scheme). These guidelines are mainly applicable to early withdrawals from Provident Fund & provisions related to PF withdrawals. These latest EPF withdrawal rules are effective from 10th February, 2016.

These Amendments are related to;

- Continuity of EPF membership.

- Full EPF balance cannot be withdrawn before attaining the Retirement Age.

- Increase in Age limit to withdraw 90% of PF balance.

- Increase of retirement age.

- Partial withdrawal of EPF amount on Resignation.

The Rules of the new PF withdrawal are as follow.

Latest EPF Withdrawal Rules

- Full EPF balance cannot be withdrawn (limit on early PF withdrawals)

- Present rule: The EPF members (employees) can withdraw the full EPF balance after 60 days of unemployment. (The EPF balance consists of employee’s contributions + employer’s contributions + interest amounts. Every month 12% of your ‘salary’ is contributed towards EPF account.)

- New Rule : The EPF members cannot withdraw full PF amount before attaining the age of retirement. The maximum withdrawal on cessation of employment cannot exceed an amount aggregating employee’s own contribution and interest accrued thereon. You can withdraw your contributions + interest portion only. The employer’s portion can be withdrawn after attaining the retirement age (58 years).

- Continuity of your EPF membership

- Present rule: If an employee withdraws full EPF amount after resigning from the job, his/her PF membership is deemed to be terminated. That means he/she is not a member of EPF scheme after the full withdrawal.

- New Rule: An employee can only withdraw his share on resigning from the job. You cannot withdraw full EPF amount before attaining the retirement age. So, you will still be the member of EPF even if you cease to be an employee of a EPF covered establishment. I believe that concept of ‘In-operative EPF a/c‘ may cease to exist.

- Retirement Age

- Present rule: The retirement age is considered as 55 years.

- New Rule: The age of retirement has now been increased from 55 to 58 years.

- EPF Withdrawal provisions

- Present rule: You (employee) can withdraw the full PF amount on retirement from service (55 years) or on cessation of employment and not being employed for at least 60 days.

- New rule: As discussed above, the retirement age has now been increased from 55 to 58 years and the option of full EPF withdrawal on resignation will not be allowed. You can withdraw your contributions + interest portion only.

- 90% of EPF balance

- Present rule: You can withdraw up to 90% of your entire PF balance (employee share + employer share) on attaining 54 years of age or within one year before actual retirement, whichever is later.

- New rule: You would now be able to avail this option only on attaining the age of 57 years. The age has now been increased from the current 54 years to 57 years.

Budget 2016 & EPF Scheme New Rules

The Budget 2016-17 proposal of levying income tax on 60% of EPF balance has been withdrawn by the government. So, no tax will be levied on PF withdrawals at the time of retirement. The other Budget proposal to make 40 per cent of the total withdrawal from the National Pension Scheme (NPS) will however remain unchanged.

Your EPF contributions / savings are meant for your retirement. Dipping into the corpus before you retire prevents your money to gain from the power of compounding.

These new rules may FORCE you to accumulate a portion of your PF fund till you attain the retirement age. Besides above new rules, kindly note that the withdrawals from the EPF within five years of joining are taxable.

TDS has been made applicable if one withdraws PF within 5 years. (Budget 2016 update : In case of payment of accumulated balance due to an employee in EPF, the TDS limit is being raised from Rs 30,000 to Rs 50,000. So, TDS is not applicable if the PF withdrawal amount is less than Rs 50,000. This new amendment is applicable with effective from 1st June, 2016.)

Proposed EPF Withdrawal Rules with effective from 1st August, 2016

- The proposed new withdrawal rules will be implemented from 1st Aug 2016.

- The amended rules do not allow an employee to withdraw the entire amount from his or her PF account till the subscriber attains the age of 58, the age of retirement.

- According to the new rules, he/she can only withdraw the contribution to the PF and interest accrued on it. The employer’s contribution and interest can only be withdrawn after attaining the age of retirement.

- Based on the public feedback/backlash, it has been decided that ‘Full PF accumulations (Employees + Employer’s share + interest) will be paid to the EPF member on fulfilling any of the following conditions;

- Housing purpose of a member.

- Medical treatment – Self / family member suffering from TB, Leprosy, Paralysis, cancer or Heart operation.

- Marriage of children.

- Professional education of children (like Medical/Engineering/Dental).

- If EPF member joins an establishment belonging to or under the control of the Central or State Government and becomes a member of Contributory PF or any old age Pension scheme.

The above said provisions/rules will be effective from 01-Aug-206 and the necessary notification will soon be released in the official Gazette of India.