New Delhi: This article contains

- GST – Concept & Status

- FAQs on GST English.

- CGST, UTGST, IGST & Compensation Acts

- CGST Rules

Constitutional Amendment Act

Who can raise a tax invoice?

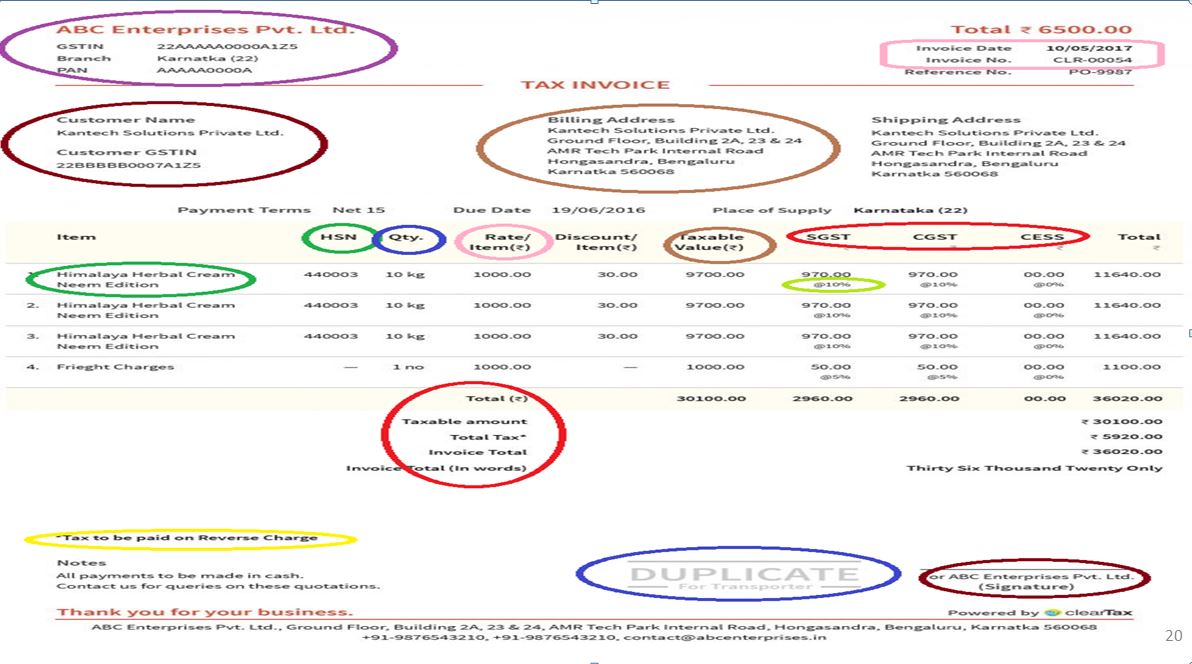

IMPORTANT CONTENTS OF TAX INVOICE

- GSTIN of supplier

- Consecutive Serial Number & date of issue

- GSTIN of recipient, if registered

- Name & address of recipient, if not registered

- HSN

- Description of goods or services

- Quantity in case of goods

What should be there in a tax invoice?

Digits of HSN Codes to be included: Notification 12/2017-CT, dated 28.06.2017

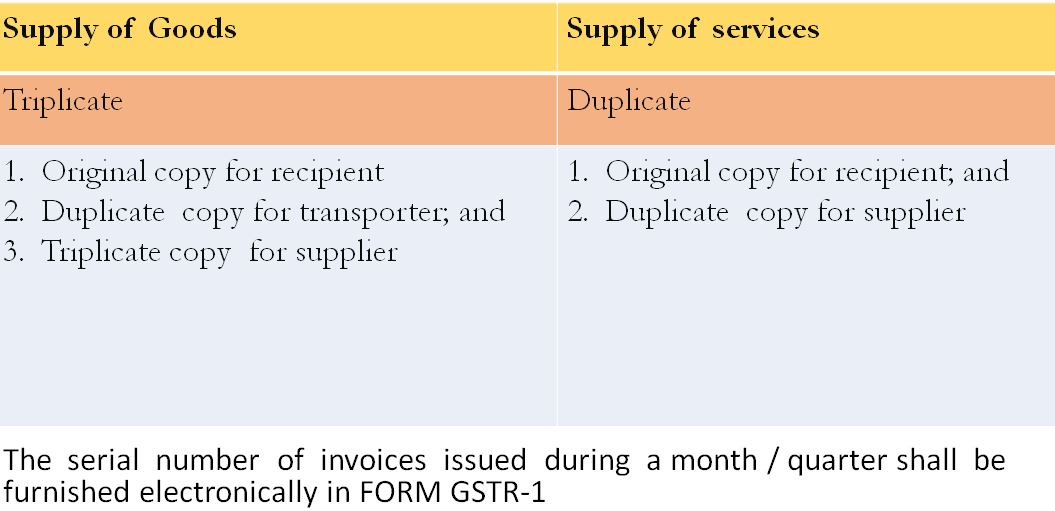

How to raise an invoice?

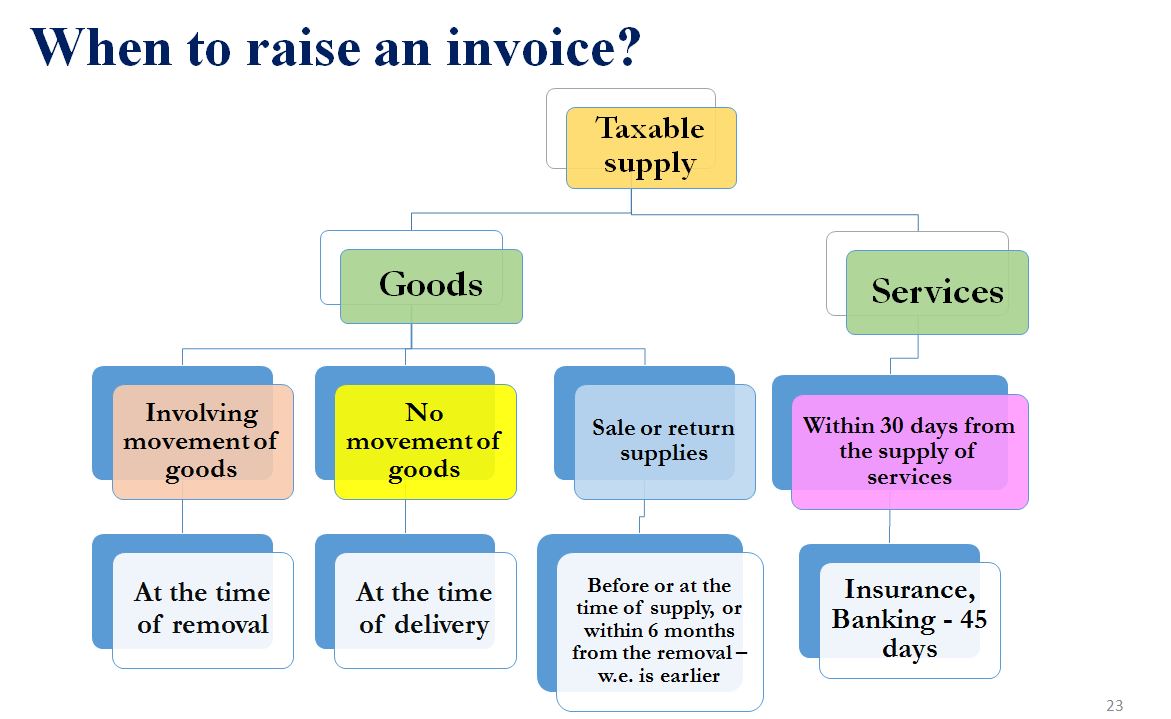

When to raise an invoice?

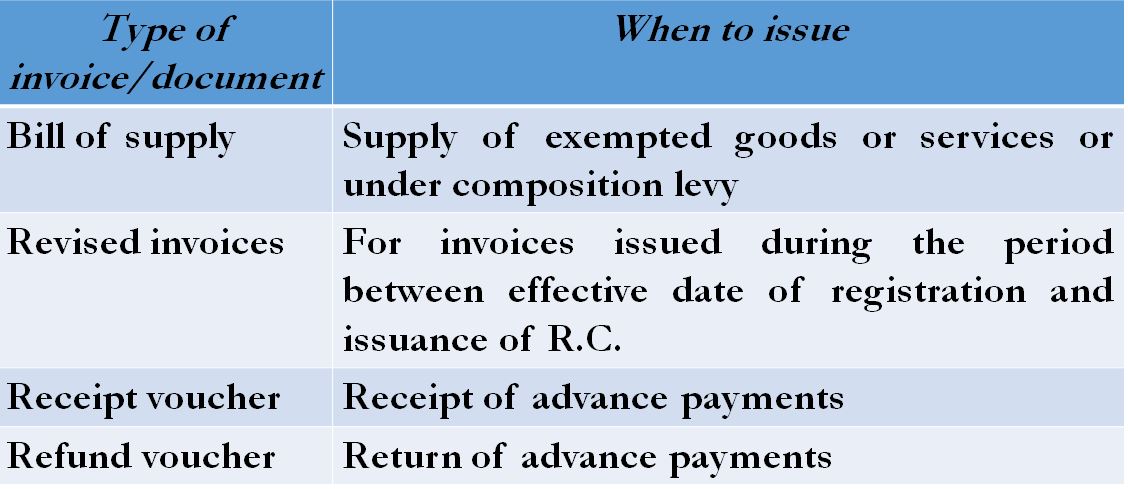

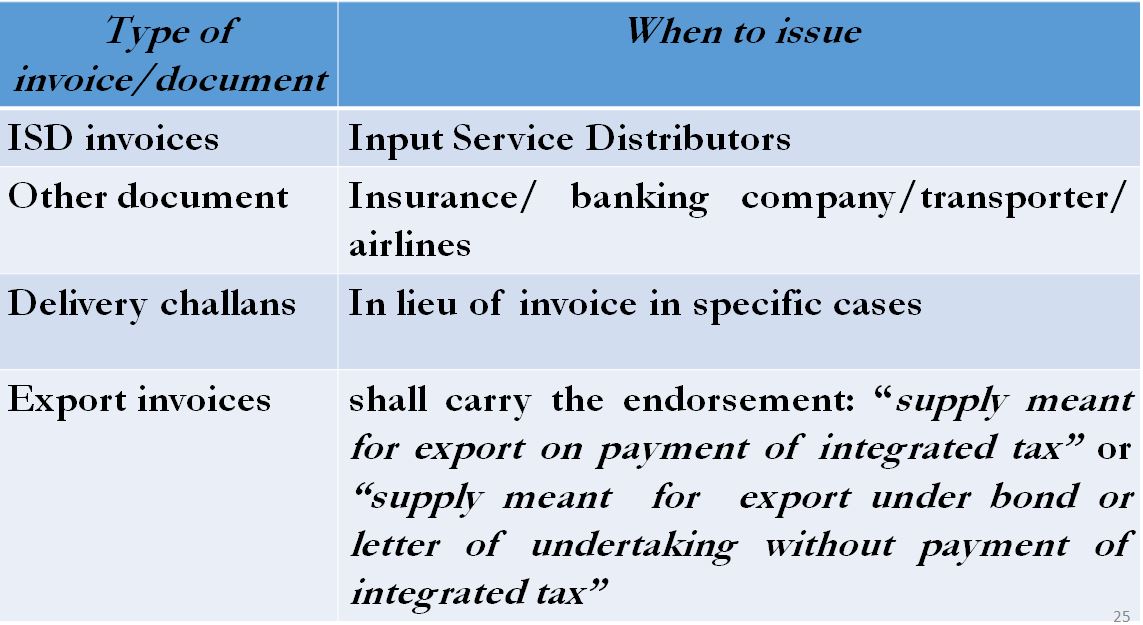

Special cases

Special cases

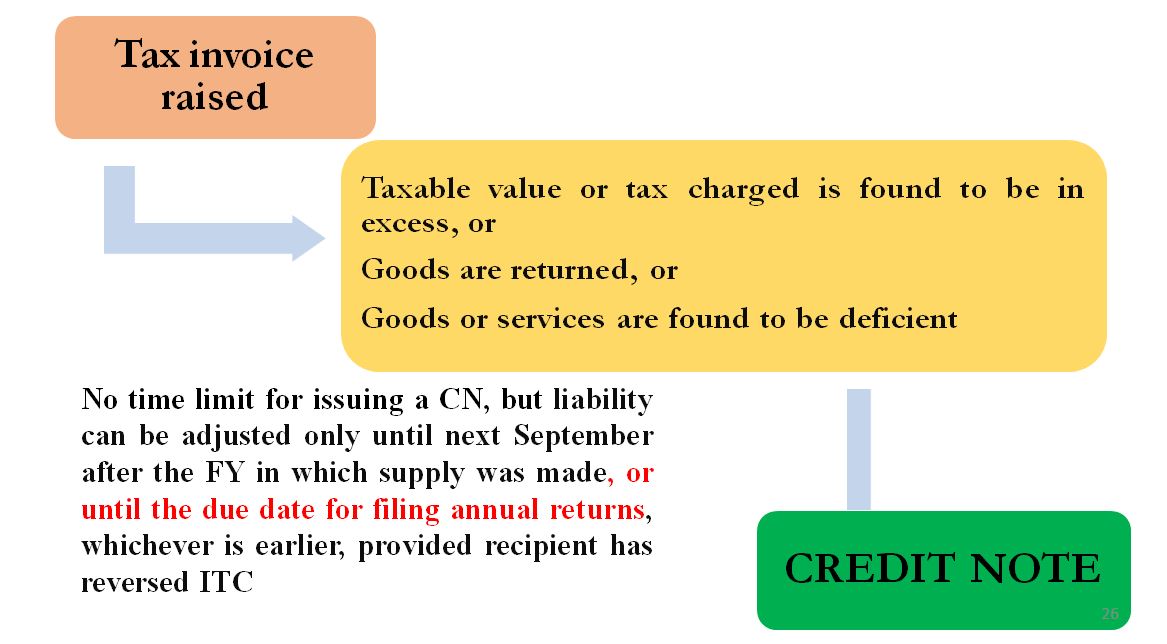

Credit Note

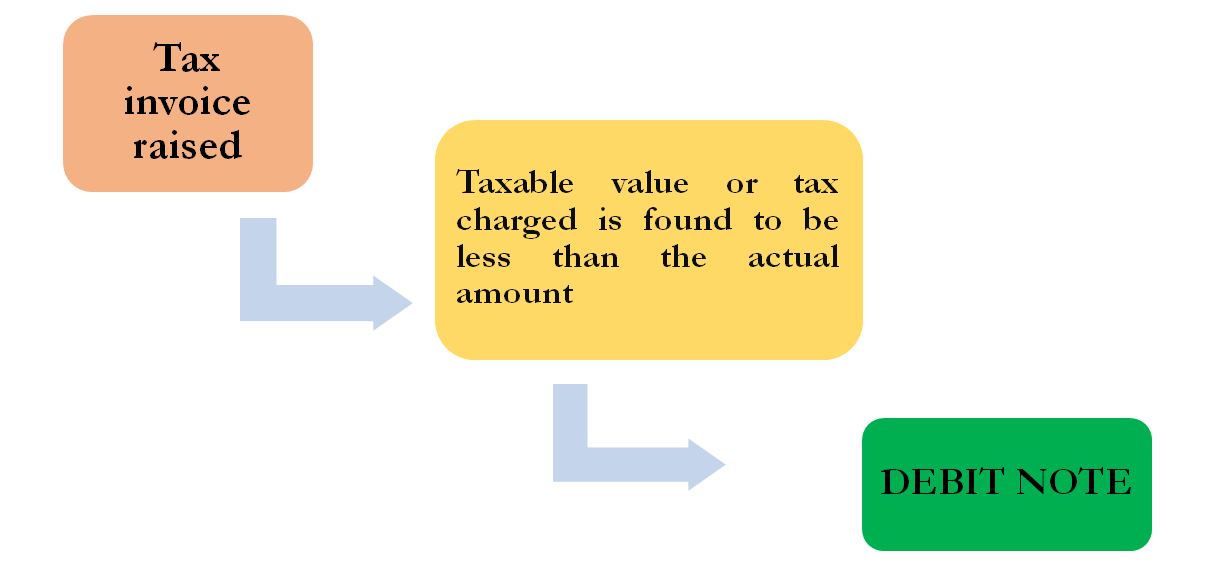

Debit Note

Read More news