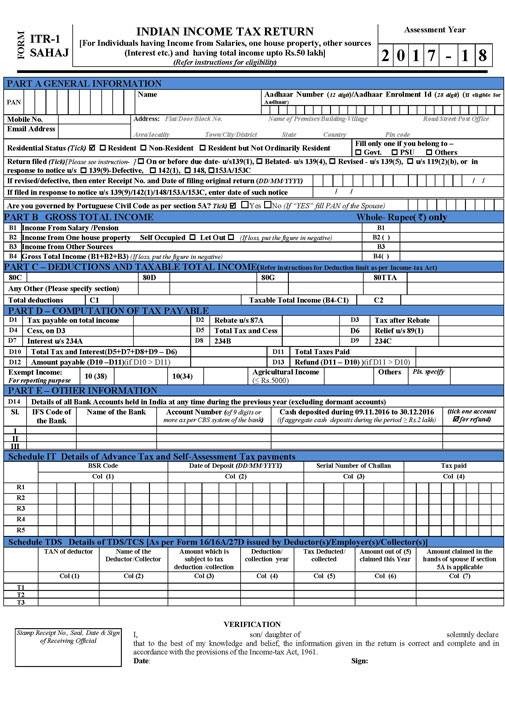

New Delhi: Filing of income tax just got simpler with the government introducing the new Income Tax Return (ITR) forms for salaried individuals, reducing the compliance burden on the individual tax payer. The Central Board of Direct Taxes (CBDT), in a major reform, today notified a much easier and simpler, one-page form for filing income tax returns, ITR Form-1 (Sahaj). Sahaj replaces the 7-page form, removing a plethora of columns on deductions from income claimed. It has also made it mandatory to disclose bank deposits of more than Rs 2 lakh post demonetization and also quote 12-digit biometric identifier Aadhaar number.

New Income Tax Return Forms for AY 2017-18

A press statement issued by CBDT said, "This ITR form-1(Sahaj) can be filed by an individual having income upto Rs 50 lakh and who is receiving income from salary, one house property and other income."

The reform also sees reduction in the number of ITR Forms from the existing nine to seven forms. "The existing ITR Forms ITR-2, ITR-2A and ITR-3 have been rationalized and a single ITR-2 has been notified in place of these three forms. Consequently, ITR-4 and ITR-4S (Sugam) have been renumbered as ITR-3 and ITR-4 (Sugam)," the CBDT said.

It is most likely that the e-filing facility for ITR-1 will be activated from April 1 onwards and the returns can be filed till the mandated deadline of July 31. The taxpayer has to fill in his PAN, personal information and information on taxes paid, Aadhaar number in the form, and TDS will be auto-filled.

According to the government, the new reform will encourage more people to file their income tax returns. Reports suggest that only around 6 crore out of 29 crore people holding permanent account number (PAN) file income tax returns.