Demonetisation Positive Effect, State Bank of India (SBI): After the pressure and tense in the public, especially after the demonetization effect. There was a lot of question what is the positive effect of the Demonetization. Immediately after the New Year the MCLR and Bps reduction by banks, will give a huge benefit to the loan borrowers it will reduce the amount they pay after taking loan to their respective bank.

The 90 basis points (BPS) cut by India’s largest render is surely going to be great relief to loan borrowers. In simple words as reported in economic times we can state that, if someone has borrowed money for 25 years tenure then, this 90 BPS will reduce the repayment option by almost 5 years.

As per the statement issued by the State Bank of India, its one-year Marginal Cost of Funds based Lending Rate (MCLR) would be 8 per cent as compared with 8.9 per cent earlier. However home loans linked to the marginal cost of funds lending rate (MCLR) may not see an immediate rate revision, as different banks have different period of rate revision. The rate cut will be applicable to all fresh loans. The new loan taken must have the effective interest rate between likely to be between 8.25 per cent and 8.5 per cent. The old loans linked to the MCLR will be impacted when they are re-priced.

Arundhati Bhattacharya told The Hindu on question if all the loans that are linked to MCLR will be impacted, she said, “It will impact all the new loans… and the old loans as and when they are renewed and re-priced.”

The bank has also reduced its base rate by 5 bps to 9.25 per cent.

The SBI has reduced this rates earlier in Nov when the government introduced the Ban on notes, then it had reduced the MCLR by 15 bps in November.

|

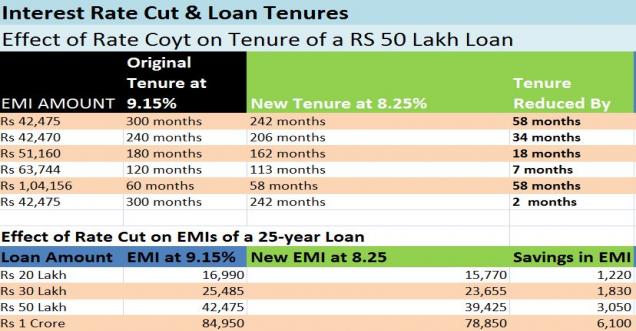

Interest Rate Cut & Loan Tenures |

|||

|

Effect of Rate Cut on Tenure of a RS 50 Lakh Loan |

|||

|

EMI AMOUNT |

Original Tenure at 9.15% |

New Tenure at 8.25% |

Tenure Reduced By |

|

Rs 42,475 |

300 months |

242 months |

58 months |

|

Rs 42,470 |

240 months |

206 months |

34 months |

|

Rs 51,160 |

180 months |

162 months |

18 months |

|

Rs 63,744 |

120 months |

113 months |

7 months |

|

Rs 1,04,156 |

60 months |

58 months |

58 months |

|

Rs 42,475 |

300 months |

242 months |

2 months |

|

Effect of Rate Cut on EMIs of a 25-year Loan |

|||

|

Loan Amount |

EMI at 9.15% |

New EMI at 8.25 |

Savings in EMI |

|

Rs 20 Lakh |

16,990 |

15,770 |

1,220 |

|

Rs 30 Lakh |

25,485 |

23,655 |

1,830 |

|

Rs 50 Lakh |

42,475 |

39,425 |

3,050 |

|

Rs 1 Crore |

84,950 |

78,850 |

6,100 |

Since SBI had reduced these rates, now other banks are following this rate cut and are doing so one by one.

- Union Bank of India has also reduced its MCLR with the one-year rate coming down by 65 bps to 8.65 per cent.

- The IDBI Bank announced reduction in its two-year MCLR by 40 bps to 9.2 per cent, and the 1-year MCLR was reduced by 15 bps to 9.15 per cent, last friday.

All the banks have made the new MCLR effective January 1.

Earlier on 31st Dec the PM Narendra Modi had appealed to banks to keep the poor, the lower middle-class, and the middle-class on focus of their activities.