New Delhi, Central Government and RBI: Ever since the announcement of the demonetisation, the Modi government kept on improvising from the idea of the implementation of the scheme. Earlier the Bank had given time till the end of the year till when the money can be withdrawn or can be changed, however it kept on changing.

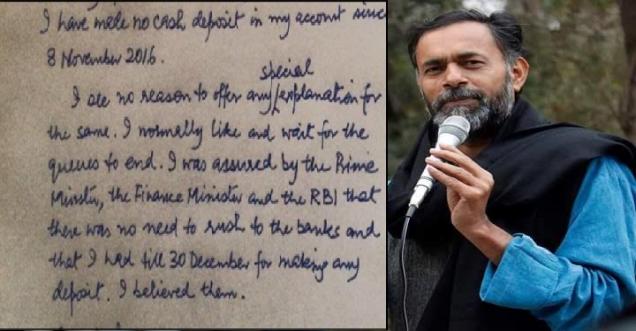

Viral letter from Yogendra Yadav explanation to the bank

This is the "explanation" I have given to my bank for making a small deposit today.

"... I have made no cash deposit in my account since 8 november 2016.

I see no reason to offer any special explanation for the same [for making the deposit now]. I normally like and wait for the queues to end. I was assured by the Prime Minister,the Finance Minister and the RBI that there was no need to rush to the banks and that I had till 30 December for making any deposit. I believed them."

"... 8 नवंबर 2016 से आज तक मैंनें कोई कैश अपने अकाउंट में जमा नहीं करवाया है।

मुझे कोई कारण समझ में नहीं आता कि मैं इसके [बैंक में देरी से डिपोज़िट करवाने] लिए विशेष स्पष्टीकरण क्यों दूँ। आमतौर पर मैं क़तार ख़त्म होने का इंतज़ार करना पसंद करता हूँ। प्रधानमंत्री, वित्तमंत्री और आरबीआई ने मुझे आश्वासन दिया था कि बैंकों की ओर भागने की ज़रूरत नहीं है, डिपॉजिट के लिए मेरे पास 30 दिसंबर तक का समय रहेगा। मैंनें उनका भरोसा किया।"

How the Modi Government and The RBI thoughts never matched and changed over time

1. Deposit Your Old Currency Notes

The Reserve Bank of India (RBI) said that people can depost their old notes till 30th of December; however the Modi government changes the laws on 19 December. As per the new law people can deposit for then Rs 5000 only in one time. If someone deposits it for more than one time questions will be asked. This was done by the entral government thinking that the people were depositing money from some other source apart from their own money.

2. On many Utilities where currency can be used

Initially the old notes were acceptable at petrol pumps, milk booth till 72 hours and later it kept on increasing. Latter it was added to other places as well like the till plaza etc.

3. Purchase for the farmers

Later the government realized that the in the villages the farmers can have more problem in exchanging and getting new money so they allowed the farmers to use the old currency notes to by seed, especially for Rabi crop.

4. Changing ATM withdrawal

Started with Rs 2000 limit restriction, later the government changed Is to Rs 2500 and then again to Rs 2000.

5. Withdrawal from Banks:

Initial week the Government allowed the max withdrawal from the bank to Rs 10000 and later it was increased to Rs 24000 for the savings account holder and the current account holder can withdraw up to Rs 50000.

6. Marriage withdrawal: the Government said further seeing the marriage session that the people are allowed to take up to Rs 2.5 lakh if some marriage in the house.